- Upstream Updates

- Posts

- Upstream Updates - Friday, June 14, 2024

Upstream Updates - Friday, June 14, 2024

For updates throughout the day....follow us on X (Twitter) @upstreamupdates

| Today’s Upstream Updates

Oil set to gain 3% this week despite negative inventory outlook

Natural Gas prices pull back slightly, though bullish sentiment remains

Crescent Energy priced its $750 MM private notes - details below

| Markets - Energy Prices

Product | Close | $ Change | % Change |

|---|---|---|---|

WTI Oil | $78.90 | +$0.28 | +0.36% |

Brent Crude | $83.17 | +$0.42 | +0.51% |

HH Natural Gas | $2.983 | +$0.024 | +0.71% |

XOP | $145.19 | -$2.28 | -1.55% |

Note: pricing is as of time of publishing.

| Morning News - Energy

Oil set for strongest weekly gains since April (FXempire)

Natural Gas set for healthy pull back (FXempire)

Gas storage increased 74 Bcf, still running north of 5-yr avg. (EIA)

Largest US oil trade group sues Biden over EV push (Reuters)

Aramco and NexDecade’s Rio Grande LNG agreement (WorldOil)

OPEC calls for more investment to prevent shortfall (CNBC)

Google partners with Nevada utility for geothermal power (Reuters)

Only three companies bid on Cook Inlet auction (Anchorage Daily)

US crude dominating global markets (OilPrice)

OPEC sees no peak demand long term (Reuters)

Texas Pacific announces $10/share special dividend (Release)

Crescent Energy prices private placement senior notes - details below

| Noteworthy from Energy X (Twitter)

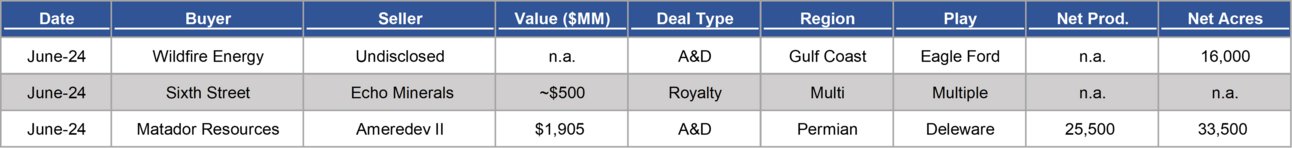

| Monthly Upstream Deals

| Monthly Capital Markets

Debt 6/13/2024 - Crescent Energy (CRGY) announced the pricing of $750 million senior notes due 2033. Notes will pay an interest rate of 7.375% per year and were priced at par. Proceeds will be used to fund the cash portion of the consideration of the previously announced merger with SilverBow Resources. Should the merger not happen, CRGY will redeem the notes for their full value and unpaid accrued interest (Link).

Debt 6/03/2024 - Diversified Energy (DEC) announced it has closed on an ABS refinancing. The $610 million principal notes with net proceeds of $592 million (net of fees, expenses and interest reserve) carry a blended fixed coupon of 7.28%. Proceeds to refinance existing ABS and reduce borrowings on Company RBL. Financing is also part of the Oaktree WI purchase. DEC noted the offering was oversubscribed with over $1.7 billion in orders from 18 investors (Link).

| Partnerships

Interested in promoting your business to our network? Advertise in Upstream Updates by contacting us today at [email protected].

Disclaimer - The information provided in this newsletter is for informational purposes only and should not be construed as investment advice. The contents and references herein do not constitute a recommendation to buy, sell, or hold any securities. Readers are encouraged to conduct their own research and consult with a qualified financial advisor before making any investment decisions based on the information provided herein. The authors and publisher of this newsletter are not liable for any actions taken by readers based on the information contained herein.