- Upstream Updates

- Posts

- Upstream Updates - Wednesday, June 12, 2024

Upstream Updates - Wednesday, June 12, 2024

For updates throughout the day....follow us on X (Twitter) @upstreamupdates

| Today’s Upstream Updates

Oil traded higher early Wednesday as three key forecasters are predicting oil supply will fall second half of 2024

An overall bullish sentiment continues to support natural gas prices

API, crude inventories fell last week by 2.4 million barrels - article below

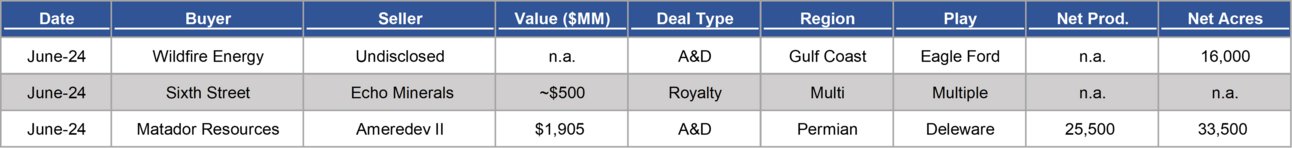

Deal Announcement - Matador Resources to acquire Ameredev for $1.9 billion in the Delaware Basin

| Markets - Energy Prices

Product | Close | $ Change | % Change |

|---|---|---|---|

WTI Oil | $78.85 | +$0.95 | +1.22% |

Brent Crude | $82.76 | +$0.84 | +1.03% |

HH Natural Gas | $3.077 | -$0.063 | -2.01% |

XOP | $149.28 | +$0.48 | +0.32% |

Note: pricing is as of time of publishing.

| Morning News - Energy

Oil perks up on inventory draw down (Reuters)

Rising fuel demand is driving bullish oil sentiment (oilprice)

Matador Resources to acquire Ameredev Resources (Release)

What does Conoco Marathon’s merger mean for the Permian (oilprice)

Vista Energy to import SLB fracking set for Vaca Muerta (WorldOil)

US EIA bumps forecast for drop in US nat gas production (boereport)

Nat gas above $3 thanks to summer heat, curtailments (Hart Energy)

Goldman says oil may hit $86 this summer (Fox Business)

API - Inventories of US crude products declined (oilprice)

EIA updates short-term production forecasts upwards (EIA)

Mexico’s proven oil reserves fall, natural gas reserves up (Reuters)

The duo atop the most contentious LNG exporter (Reuters)

Battalion Oil extends merger agreement to give Fury more time (SEC)

Echo divests mineral/royalty Permian and Mid-Con assets (Release)

IEA - Oil demand set to peak by 2029, glut of supply (Reuters)

| Noteworthy from Energy X (Twitter)

| Monthly Upstream Deals

| Monthly Capital Markets

Debt 6/03/2024 - Diversified Energy (DEC) announced it has closed on an ABS refinancing. The $610 million principal notes with net proceeds of $592 million (net of fees, expenses and interest reserve) carry a blended fixed coupon of 7.28%. Proceeds to refinance existing ABS and reduce borrowings on Company RBL. Financing is also part of the Oaktree WI purchase. DEC noted the offering was oversubscribed with over $1.7 billion in orders from 18 investors (Link).

| Partnerships

Interested in promoting your business to our network? Advertise in Upstream Updates by contacting us today at [email protected].

Disclaimer - The information provided in this newsletter is for informational purposes only and should not be construed as investment advice. The contents and references herein do not constitute a recommendation to buy, sell, or hold any securities. Readers are encouraged to conduct their own research and consult with a qualified financial advisor before making any investment decisions based on the information provided herein. The authors and publisher of this newsletter are not liable for any actions taken by readers based on the information contained herein.